Keeping Up-to-Date With Suske Capital

Latest News & Events

Latest News from The Suske Capital Weekly

Stay in the loop with the latest happenings in the seniors housing industry and Suske Capital’s projects by subscribing to our weekly newsletter. Sign up below to ensure you’re always informed on industry happenings and our latest initiatives.

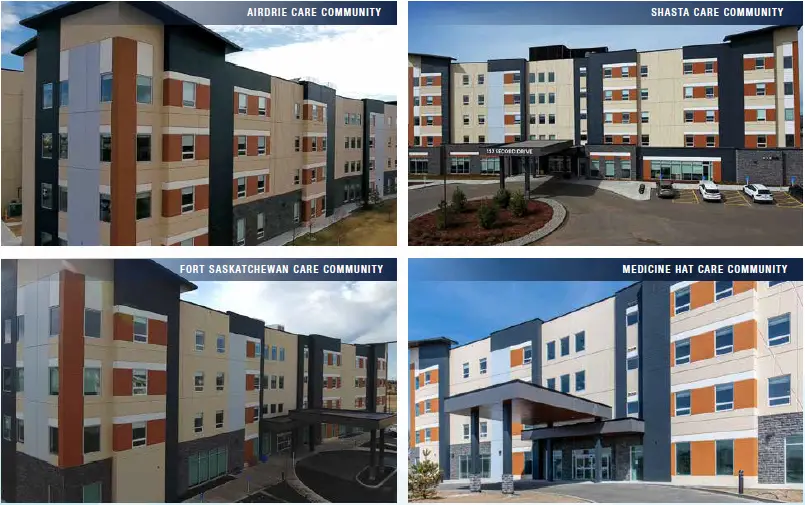

Suske Capital is pleased to announce the sale of four continuing care homes in Alberta to Sienna Senior Living.

On October 16, Sienna Senior Living announced their expansion into Alberta with the acquisition of a portfolio of four continuing care homes. Suske Capital is part of the ownership group of these four properties through their investment 103 Street Developments.

The four properties are Shasta Care Community in Edmonton; Airdrie Care Community in the Calgary Metropolitan Region; Medicine Hat Care Community in Medicine Hat; and Fort Saskatchewan Care Community in Fort Saskatchewan. The portfolio consists of 540 suites for an aggregate purchase price of $181.6M or $185.6M subject to performance targets by March 2026.

"This transaction highlights our commitment to creating high-quality care environments for seniors," said Steve Suske, President and CEO of Suske Capital. "We are proud of the work we've done alongside our partners to develop these communities, and we are confident that under Sienna’s leadership, these homes will continue to thrive and provide exceptional care for residents."

Suske Capital has been involved with these projects from the beginning, when we worked with 103 Street to submit successful RFP proposals for these and three other properties.

Key contributors to the success of these developments include Doug Mills, Doug Murphy, Georg Rath, and Paul Melanson of 103 Street Developments. The late Doug Mills excelled at many things, but development was his passion, and these projects are due in large part to his vision.

The construction of these properties was expertly managed by Eagle Builders, with special thanks to Craig Haan and Shelley Boston for their instrumental role in getting the sale across the line.

We also extend our appreciation to Mike Chiu at Capital West for arranging the CMHC financing on these properties and to Newmark Canada for managing the sales process. Three of the four properties were operated by Connecting Care, a Suske Capital investment, while the fourth was run by Optima Living. Their outstanding commitment to resident care has been essential to the success of the projects, and we thank both organizations and their care teams for their hard work.

Lastly, we would like to recognize Suske Capital Associate Dayna Chernoff, whose dedication from the RFP stage through to the sale was invaluable in seeing these projects come to fruition.

The acquisition is expected to close in early 2025, pending regulatory approvals.

Suske Capital, along with its partners Avenir Senior Living and Sussex Retirement Living, is pleased to announce the sale of three high-quality seniors housing properties to Chartwell Retirement Residences (“Chartwell”), Canada's largest owner and operator of retirement residences.

Suske Capital has had a busy summer, and currently has $672.9 million in assets under contract, with these three properties being the first to be announced in a series of planned sales.

The acquisition consists of three modern retirement residences on Vancouver Island totaling 384 suites for an aggregate purchase price of $226.9 million, consisting of:

- The 152-suite Vista Retirement Residence (“Vista”), located in Victoria, built in 2023, which offers a continuum of care with independent supporting living (“ISL”), assisted living and memory care services.

- Nanaimo Memory Care (“Nanaimo MC”), located in Nanaimo, built in 2018, comprised of 77 suites; and

- The Edgewater Retirement Residence (“The Edgewater”), located adjacent to the Nanaimo MC, currently under construction, which will be comprised of 155 suites offering ISL services. Chartwell will acquire the residence upon construction completion, which is expected in Q2, 2025.

Vista Retirement Residence

Vista is an upscale residence located in the charming Victoria suburb of Esquimalt, within walking distance to numerous retail and service amenities. The 11-storey residence currently offers a continuum of care, with 104 ISL suites and 48 memory care suites. The residence boasts large and well-appointed common areas, and beautiful ocean views. The residence is currently 28% occupied. The gross purchase price for the Vista is $103.9 million, of which $9.2 million will be held in escrow to support vendors’ obligation under a 24-month Net Operating Income (“NOI”) Guarantee.

Nanaimo Memory Care

Nanaimo MC is located in the north end of the City of Nanaimo on Long Lake. The area offers a serene backdrop and easy access to retail, medical care and entertainment amenities. The residence provides memory care services and is currently 88% occupied. The purchase price for the Nanaimo MC is $20.3 million. Chartwell expects the closing of the Vista and Nanaimo MC acquisitions to occur in Q4, 2024.

The Edgewater Retirement Residence

The Edgewater, located adjacent to Nanaimo MC and currently under construction, will be comprised of 155 ISL suites with ample and modern amenities. Construction is expected to be completed in Q2, 2025, at which point Chartwell will acquire the residence. The gross purchase price for The Edgewater will be $102.7 million of which $8.7 million will be held in escrow to support vendors’ obligation under the 36-month NOI Guarantee.

“These acquisitions of high quality, newly developed residences will positively contribute to the overall quality of Chartwell's portfolio and expand our presence in the strong British Columbia market. These transactions will create meaningful scale on Vancouver Island, which provides operating and management synergies. We believe the quality of the acquired properties and their excellent locations, combined with our operating expertise, will support successful lease up and multiyear occupancy and market rate growth. We are pleased to acquire these properties in Canada’s retirement destination below current replacement cost.” said Jonathan Boulakia, Chartwell’s Chief Investment Officer.

Suske Capital Continues its Ongoing Relationship with Chartwell

Over the years, Suske Capital has established a strong track record of developing and selling premium seniors housing properties to prominent public companies, including Chartwell Retirement Residences. This latest transaction brings the total number of projects sold to Chartwell by Suske Capital entities to nine, reinforcing the long-standing relationship between the two organizations. Suske Capital also has two more projects we are currently working on with Chartwell.

"We are incredibly proud of the teams at Avenir, Sussex and Suske Capital who worked to develop these properties," said Steve Suske, CEO of Suske Capital. "This sale is a testament to the quality of our developments and our commitment to enhancing the lives of seniors. We extend our heartfelt thanks to our partners at Avenir and Sussex, as well Vlad Volodarski, CEO at Chartwell, Jonathan Boulakia, CIO at Chartwell, and Gord Neely, VP, Real Estate Investments at Chartwell. We would also like to thank the team at Newmark Canada who worked on this transaction."

Chartwell Retirement Residences was founded by Suske Capital CEO, Steve Suske, and has been a trusted name in seniors housing for decades, known for its commitment to providing safe, comfortable, and engaging environments for its residents. By acquiring these properties, Chartwell continues to expand its portfolio, offering more seniors the opportunity to experience its exceptional standard of care.

As Suske Capital looks ahead, the company remains focused on its mission to develop and deliver top-tier senior living communities that set new benchmarks in the industry. This sale represents a significant step forward in that journey, paving the way for future growth and continued collaboration with industry leaders like Chartwell.

Read previous issues of The Suske Capital Weekly

Latest Events

On Friday, November 24, 2023, Core & Partners and Suske Capital hosted over 70 guests, advisors, and investors for a Red-Carpet Event at Wayne Gretzky Estates Winery in Niagara on the Lake.

This event launched the partnership between Suske Capital & Core and Partners.

The event kicked off with a red carpet entrance complete with a photo station, wine, and hors d’oeuvres.

Guests then made their way into the winery tasting room to learn about the exciting opportunities that Suske Capital & Core and Partners have been working on.

Guests visited one of four stations to learn more about each opportunity, and then took their seats for an interview session hosted by Core & Partners CEO Roberto Lloren.

Watch the video below for some highlights from the event.

Connect With Us

Please provide us with your information and we’ll get back to you as soon as possible.